By: Nicole Cheng (OFR Investment Manager)

Advisor: JX (OFR Partner)

Over the past year, we have witnessed explosive growth in the NFT space, but we are also aware of a fact that cannot be ignored: the more NFTs (non-fungible tokens) are collected, the less liquid the portfolio becomes. With the popularization of NFT technology and the emergence of more novel applications, in order to maximize the release of capital efficiency, the demand for NFT financialization is becoming stronger and stronger.

In fact, NFTs are illiquid assets, very similar to real estate. In the real world, real estate is often used as collateral for loans. Imagine an NFT-backed loan analogy to a home mortgage, where users can borrow against these illiquid assets as collateral. The medium that facilitates this process is the NFT mortgage loan agreement. This article will focus on such agreements, focusing on their pricing mechanisms and how they lend to different types of parties.

To be collateral, an NFT must achieve sufficient consensus on its value and have the mainstream view that it will not depreciate any time soon. Then this requires high transaction volume and a good reputation of the founder, both of which are indispensable. The more recognized collaterals in the market include CryptoPunk, BAYC, MAYC, Azuki and Doodles, the so-called 'blue chip' NFT series. Compare these 'blue chip' NFTs to mortgages, they are undoubtedly central cities, and the rarest 'blue chips' are luxury residential areas in central cities.

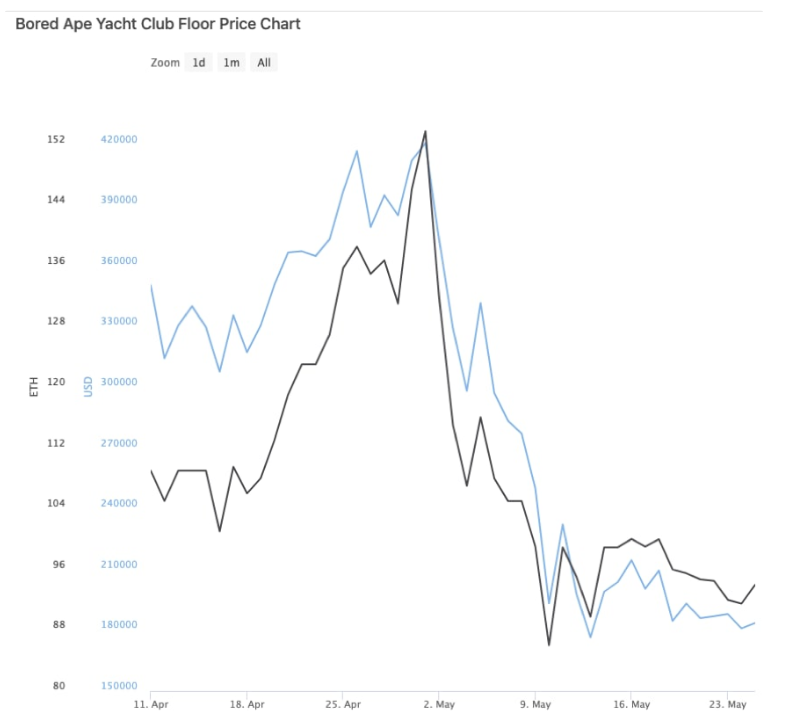

However, NFTs are highly volatile assets, and even "blue-chip" collectibles can fluctuate wildly in value. Before Otherdeed, BAYC’s floor price had hit an all-time high for ETH valuations, but it has since fallen by more than 50%. The challenge when developing a collateralized lending protocol is: how to price NFT collateral fairly? The solutions adopted by existing players are as follows:

https://www.coingecko.com/en/nft/bored-ape-yacht-club

Time Weighted Average Prices (TWAPs)

An oracle like Chainlink publishes a time-weighted average price of the sale price and reserve price, synthesizing a mixed price to evaluate NFTs. This model mitigates the impact of abnormal events by averaging multiple prices over a predetermined time period, thereby reducing the possibility of malicious manipulation.

However, the method of valuing NFTs using TWAPs has obvious shortcomings - TWAPs can only be applied to collectibles that are active in the market, have high transaction volume, and are not vulnerable to oracle attacks. TWAPs are also less capital efficient, as the protocol only tends to set a small loan-to-value ratio in order to avoid extreme market conditions.

For example: BendDAO, JPEG'd, Drops DAO, Pine Protocol, DeFrag

Peer evaluation

Peer evaluation method, that is, the user evaluates the NFT and predicts the value of the NFT. The P2P evaluation method can be applied to most NFT collectibles. Unlike TWAPs, it will limit the quality of the collectibles. It realizes NFT value discovery through reward incentives from individuals or a committee of curators, and reasonably price NFT collateral. However, the valuation cost of incentive incentives is significantly higher than other methods, the process is less efficient, and the results may be inaccurate.

Example: Taker Protocol, Upshot V1

Liquidity Pool Pricing

One of the problems with peer review is the inability to provide real-time prices for NFTs. And this situation will not appear in liquidity pool pricing. Each NFT invested in the protocol is actively traded by active lenders in the pool, resulting in a constant NFT spot price equal to the total ETH in the pool. Once the NFT is locked in the pool by the borrower, traders can deposit ETH into the pool until they reach their estimated NFT price. If the NFT is overvalued, the trader may lose ETH when the public auction occurs; conversely, if the NFT is undervalued, the trader will fill up the pool until the true market value of the NFT is reached, in order to make a profit on the sale. By encouraging speculation on NFT pools, NFT pricing will be more equitable.

Example: Abacus

While the cases enumerated above are not non-financial transaction loan agreements, these pricing mechanisms play a crucial role in determining the maximum loan amount and whether to execute a liquidation event. Once the value of the NFT is determined, the protocol can be divided into two types according to the type of transaction parties.

P2P Lending

This method is theoretically applicable to all NFTs, and it is easier to determine the potential value of NFTs. If there is an open market, lending protocols are the enablers to provide that market. On the one hand, NFT holders can lend and borrow on their desired terms; on the other hand, funding providers can browse the platform and decide who to lend the money to. Once someone accepts a loan offer, a contract is established, and the NFT used for collateral is transferred to an escrow account protected by the agreement; at the same time, the loan is transferred to the borrower along with the promissory note NFT.

Lenders and borrowers agree on loan terms such as loan term, LTV ratio, and APR, which reduces systemic risk because defaults can only happen to lenders and borrowers, not the entire system. However, although this method is flexible and customizable, it has low liquidity and scalability due to the need for mutual agreement between the lender and the borrower.

For example: NFTFi, Arcade, MetaStreet

P2Pool Lending

Unlike "bid-and-ask" loans that may never be accepted, P2Pool is more like "letting the market decide": pooling the liquidity provided by lenders and apportioning the interest paid by borrowers based on supply and demand among all parties. If the borrower is unable to repay the loan, or the NFT collateral faces liquidation due to a price drop, the protocol will auction the NFT and the proceeds will be returned to the borrower.

Through P2Pool, the amount of funds available to borrowers will be greatly increased, and at the same time, borrowers will have immediate access to liquidity without the need for lenders to confirm terms. However, this also means that they need to rely on price information from oracles to generate loan terms. Since long-tail NFT assets are more sensitive to price manipulation, this approach is only applicable to mainstream NFTs.

For example: JPEG’d, DeFrag, BendDao, MetaLend, Pine, Drops DAO

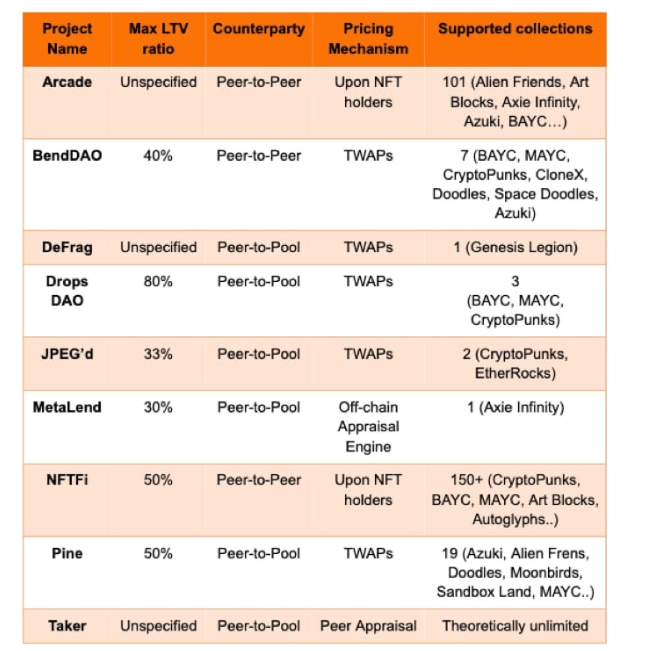

For comparison purposes, I have included a table that includes some important metrics when evaluating NFT lending protocols. Some protocols cap the loan-to-value ratio (LTV) to reduce the likelihood of default, and for NFTs with greater liquidity and demand, LTV ratios are usually higher. Due to the wider coverage of P2P protocols than most P2Pool protocols, the NFT collectibles supported by the two lending methods vary widely. It’s worth noting that most protocols are constantly expanding the collectibles they support while adjusting their pricing mechanisms and LTV ratios.

Despite the many controversies surrounding NFT mortgage lending protocols, we still expect that more NFT lending and financialized originals will enter the field, providing NFT collectors with a way to unlock greater value in digital collectibles. Looking further, if lending protocols one day lock in a sustainable number of NFTs, these protocols may have some degree of NFT pricing power. There is still a lot of untapped potential in this area, and there is no doubt that financialization will be one of the strongest outlets for NFTs this year.